Effective Tax Bracket Calculator 2025. Use this tool to determine your tax bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2025 tax year, which are the taxes due in early 2025.

See the tax rates for the 2025 tax year. Calculate your annual federal and provincial combined tax rate with our easy online tool.

Federal Tax Earnings Brackets For 2025 And 2025 bestfinanceeye, The calculator reflects known rates as of january. 2025 federal income tax brackets and rates.

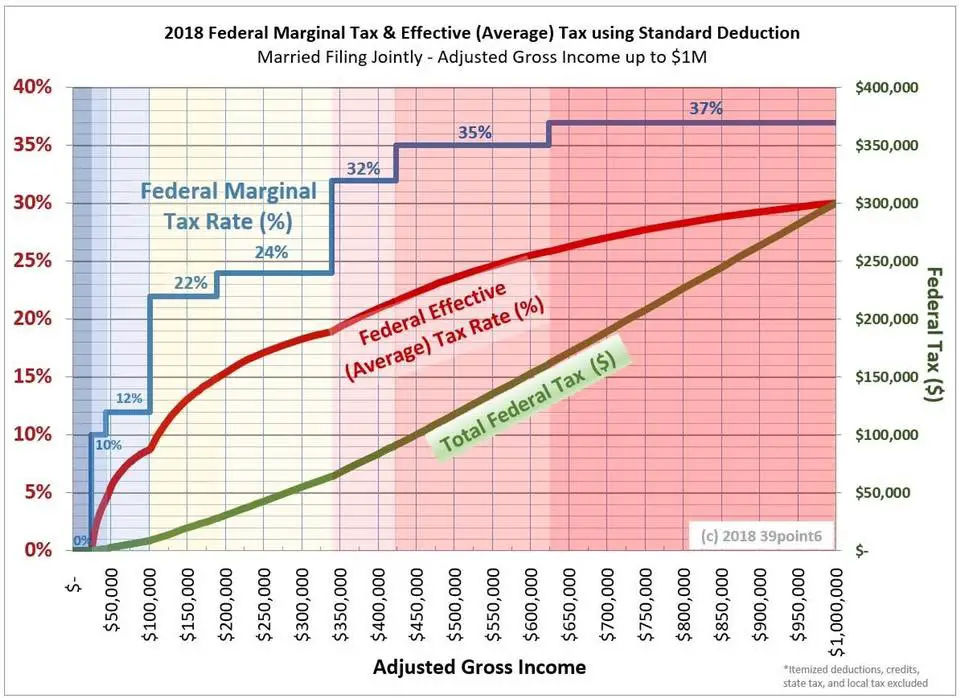

Your 2013 Tax Rate Understanding Your IRS Marginal and Effective Tax, See the tax rates for the 2025 tax year. Your marginal tax rate is the rate you’ll pay on your last—that is, highest—dollar of income.

2025 Federal Effective Tax Rate Calculator Printable Form, Templates, Income tax department > tax tools > tax calculator. Taxact’s free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax.

Tax brackets 2019 vptiklo, (as amended upto finance act, 2025) tax calculator. The marginal tax rate, however, would be the.

2025 Federal Effective Tax Rate Calculator Printable Form, Templates, Taxact’s free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax. Marginal tax rate 22% effective tax rate 10.94% federal income tax $7,660.

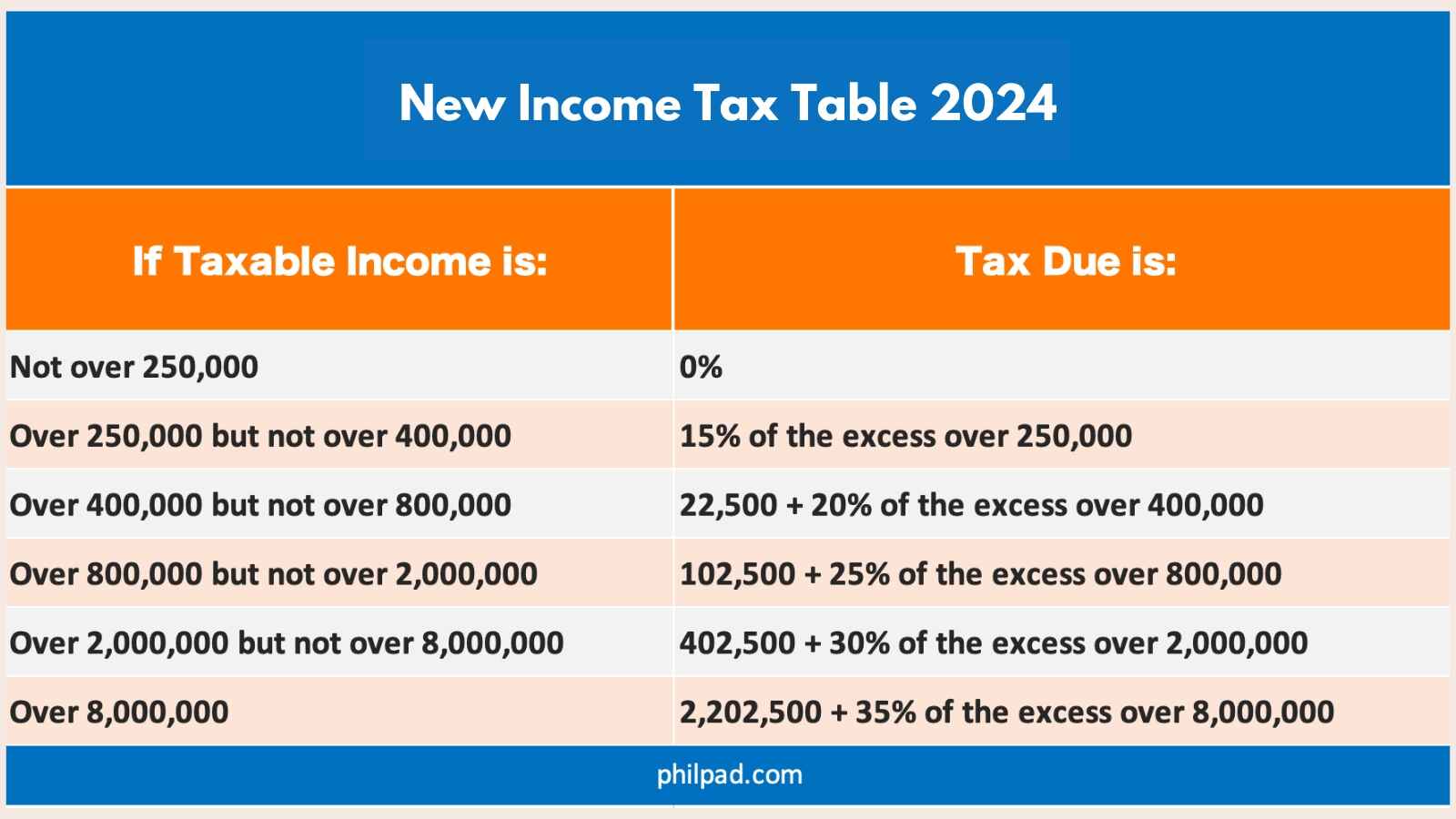

New Tax Table 2025 Philippines (BIR Tax Table), The calculator reflects known rates as of january. Taxact’s free tax bracket calculator is a simple, easy way to estimate your federal income tax bracket and total tax.

2025 Irs Tax Table Chart, The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2025 tax year, which are the taxes due in early 2025. So people in higher tax brackets will have to pay a higher tax rate on their savings account interest.

Tax rates for the 2025 year of assessment Just One Lap, Ey’s tax calculators and rate tables help simplify. For example, let's say you're in the 12% tax bracket.

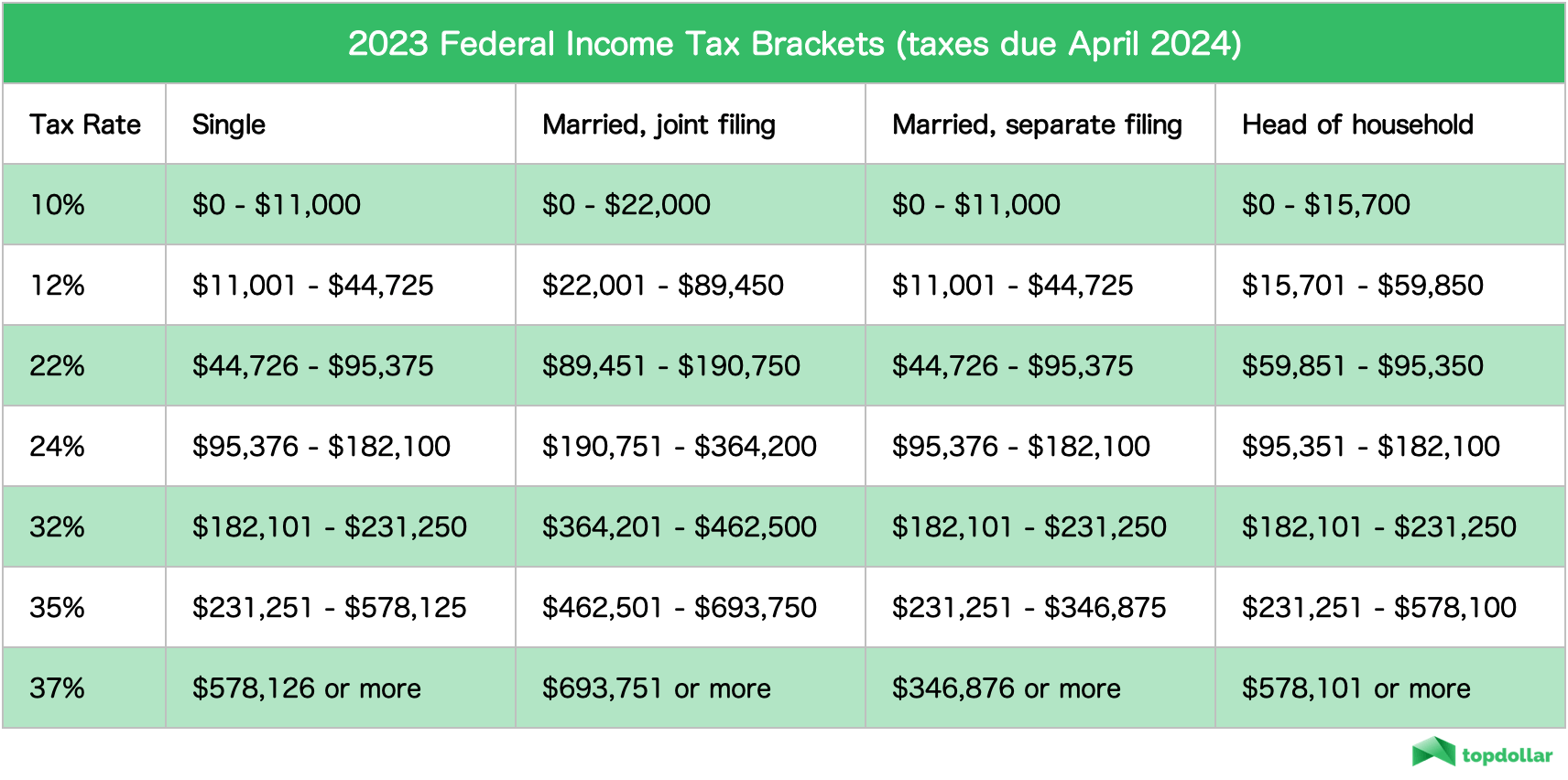

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Calculate your annual federal and provincial combined tax rate with our easy online tool.

2025 Federal Marginal Tax Rates Printable Forms Free Online, Income tax department > tax tools > tax calculator. The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons: